What Is Customer Acquisition Cost & How to Reduce It?

With the ongoing digital progression, it’s vital to understand some core business numbers. One such critical figure is the Customer Acquisition Cost, often called CAC. This figure is crucial in helping your company grow and be profitable over the long term. Understanding CAC means planning better and making decisions based on actual data.

Looking ahead, being able to handle your CAC isn’t just nice – it’s a must. CAC can usher your organization, showing you where to place your resources and where to focus your efforts for maximum return on investment. So, what’s in this article? We’re diving right into CAC.

This article will explain what it includes, how you work it out, and why it’s essential. Plus, we’ll share strategies that can assist you in managing and even lowering your CAC, all to help your business grow. The mission is to guarantee your company’s not just surviving but thriving amidst the ever-shifting business terrain. Remember, adaptation breeds success.

What Exactly Is CAC

Picture this: customer acquisition cost, the CAC game. It’s the equivalent of an all-access pass that a company must pay for in order to gain a new customer. But here’s the catch: it’s not only about advertising expenditures. Think of it as the complete package, covering every penny you invest in marketing and sales efforts.

These two concepts, CAC and CPA (cost per acquisition), are your money guides for business success. They both figure out how much it costs to hit a goal, but CAC goes all in. It adds up every dollar spent on marketing tricks and sales tactics to bring in a fresh customer. So, it’s like the full story behind getting a new client onboard.

Now, let’s switch gears to CPA – think of it as the bill for certain actions like clicks or sales. It’s not always about new customers, just different things people do. On the flip side, CAC is all about getting those new customers onboard and looking at the full spending story. So, CAC is the new customer champ, while CPA covers all sorts of actions.

Calculating Customer Acquisition Cost

Breaking it down, figuring out the customer acquisition cost formula is quite simple. You divide your total marketing expenses costs by the number of customers acquired when the money was spent. However, while the formula is simple, identifying all the costs involved in acquisition requires careful consideration.

When you’re working out your CAC, start by listing all your spending on marketing and sales. It might sound straightforward, but different costs are in the mix. Here are the expenses to think about:

- Marketing Tools and Agency Fees: Businesses often use special tools for marketing tasks, managing customer relationships, and crunching numbers. If you’ve brought in outside help from an agency for marketing or sales, those costs should be in the mix, too.

- Advertising Budget: This covers all the ways you spread the word – online, offline, you name it. Think Facebook Ads, Google Ads, and all those platforms where you tell the world about your business to get new customers interested.

- Salaries: Don’t forget the people who make things happen. Your sales and marketing crew are the ones behind the scenes, planning and putting plans into action to catch and keep customers. Their wages count, too.

– Now, let’s take a closer look at:

- Publishing, PR, and Production Costs: Think about press releases, media connections, and even creating promotional videos. These are all costs that join forces in your quest for new customers.

- Creative Costs: Making eye-catching marketing materials comes at a price. Whether you’re hiring designers or grabbing design software, these expenses are all part of the game.

- Inventory Maintenance: If you’re selling goods, remember that keeping your stock in check matters. Those inventory costs should be in the mix, too.

- Influencer Partnerships: And lastly, if your social media moves involve teaming up with influencers, don’t forget the fees you pay them – they’re part of your customer-getting costs.

Image from Surfside PPC. “What is CAC? Customer Acquisition Costs Explained for Beginners” on YouTube.

So, once you’ve got all these costs on the table, tally them up and divide them by the number of new customers you’ve brought in over a certain time. The result is your CAC. But remember, CAC doesn’t show the whole profitability picture, just a piece of it.

A free expense tracker can help you keep a close eye on these costs, ensuring you have an accurate understanding of your financial landscape.

Consider factors like your cost of goods sold, average order value, and gross margin. Let’s explore the following concepts:

- Cost of Goods Sold (COGS): This is the total cost to make your product. It includes labor and materials. When COGS is lower, you can spend more on acquiring customers (CAC) while making a profit.

- Average Order Value (AOV): This is the average amount customers spend when they buy from you. If customers spend more on each purchase (high AOV), your business can afford a higher CAC.

- Gross Margin: This is what’s left of your sales revenue after subtracting COGS. The higher the margin, the more money you have for marketing, which means you can afford a higher CAC.

Now that you’re familiar with these terms, you can get a fuller picture of your profitability. First, to determine a more precise CAC, add the COGS to your total marketing spend and divide by the number of new customers [(Total Marketing Spend + COGS) / New Customers = True CAC].

Next, calculate the AOV, which is the total revenue divided by the number of orders [Total Revenue / Number of Orders = AOV].

To determine your profit, you also need to calculate the gross margin. Subtract COGS from your net revenue [Net Revenue – COGS = Gross Margin].

Finally, you have these figures in hand (True CAC, AOV, and Gross Margin). You can compute your profitability by subtracting CAC from the product of AOV and Gross Margin [(Average Order Value x Gross Margin) – Customer Acquisition Cost = Profit]. These calculations clearly understand your profit, helping you make smarter business decisions.

– Customer Acquisition Cost Examples

Imagine running an online furniture store. To fully grasp the concept of CAC, let’s walk through a couple of simple scenarios showing the costs of gaining each new customer. As we dive into these examples, let’s explore the central role of managing CAC. These hands-on scenarios will show the significance of controlling CAC for your company’s success.

An online furniture company invests $100,000 in a marketing campaign, acquiring 5,000 new customers purchasing their products. Moreover, the business anticipates spending an additional $150,000 yearly on production costs related to these new clients.

In this situation, you calculate the CAC as follows:

CAC = (Marketing Cost + Production Cost) / Number of New Customers

CAC = ($100,000 + $150,000) ÷ 5,000 = $250,000 ÷ 5,000 = $50

The furniture company spent $50 to acquire each new client.

Let’s consider another sample scenario. An online fitness apparel company launches an advertising campaign that costs $120,000. Additionally, they spend $180,000 on production costs for newfound customers. Within this period, they managed to acquire 6,000 new clients.

Now, to calculate the CAC:

CAC = (Marketing Cost + Production Cost) / Number of New Customers

CAC = ($120,000 + $180,000) ÷ 6,000 = $300,000 ÷ 6,000 = $50

So, in this example, the fitness apparel company spent $50 to acquire each new customer.

– Relation of CAC to Customer Lifetime Value (CLV)

Indeed, navigating the financial seas of business can be tricky, but the compass of Customer Lifetime Value (CLV) and CAC can guide the way. Let’s break these notions down.

CLV is the total revenue you expect from a single customer throughout your relationship with them. Think of it as the total profits you predict to gain from a consumer during their time with your business. It’s like a client’s financial ‘scorecard,’ aiding companies to identify how much value different customers can offer over time.

CAC is the ‘price tag’ of earning a new customer. It measures the money you invest in persuading clients to purchase your product or service. In other words, it’s the total expenses your company incurs to acquire a new customer, taking into account marketing and sales costs.

The magic happens when comparing these two using the LTV: CAC ratio. This ratio tells us the value of a customer relative to the cost of acquiring them. Ideally, the LTV should be higher than the CAC, indicating that the revenue earned from a customer exceeds the cost of gaining them.

A desirable LTV: CAC ratio hovers around 3:1, meaning that for every dollar invested in customer acquisition, you expect to generate three dollars in long-term revenue.

If your ratio stays below this, you’re likely spending more money on acquiring customers. A significantly higher percentage could imply underinvestment in customer acquisition, suggesting missed opportunities for growth. Utilizing financial projections is key to enhancing the efficiency of financial management by forecasting future revenue and budgeting accordingly.

Why Is Customer Acquisition Cost Essential?

Understanding CAC is more than just helpful. It’s vital to the pulse of your business. Knowing your CAC has several benefits, from evaluating marketing strategies to identifying potential hurdles in your sales funnel.

– Assessing Strategy Effectiveness

CAC plays a significant role in determining the efficiency of your marketing efforts. If your CAC is high, you may need to re-evaluate and optimize your marketing approaches. Meanwhile, a low CAC suggests your current strategies effectively convert leads into customers.

– Budgeting Insight

Knowing your CAC allows for more informed budget allocations. It clarifies how much to invest in customer acquisition without eating into profitability. It aids in creating effective marketing and sales strategies that optimally utilize resources, eliminating wasteful spending and ensuring a healthier bottom line.

– Revenue Management Impact

The impact of CAC on profitability and business growth is considerable. A high CAC might diminish your profits, whereas understanding and managing it can help reduce costs. You can reinvest in your business with the saved revenue, supporting continued growth. However, if you’re new in this then you can hire a digital marketing agency that can help you with lowering it.

– Competitive Benchmarking

Assessing your CAC also provides a valuable benchmark against competitors in your industry. By comparing your CAC with industry standards, you can gauge how effectively your business converts marketing investment into customer growth. It helps you make intelligent changes ahead of time, staying strong in the game and making your spot in the market even better.

– Locating Sales Blocks

And there’s more: CAC can play detective, revealing hurdles in your sales journey. Keep tabs on costs at each step of gaining customers, and you’ll find the spots where potential buyers might struggle or lose interest. This info is pure gold – it guides you in smoothing out your sales process, making it better, and boosting the chances of turning curious folks into loyal customers.

Cutting Down Customer Acquisition Cost

Achieving a balance between lowering CAC and acquiring high-quality customers is vital for your business’s success. Effective strategies can help you attain this equilibrium. Let’s see how you can spend less on getting customers without sacrificing their quality.

– Increasing Reach: SEO and Content

High-quality content coupled with solid SEO is a powerful tool for drawing in organic traffic to your business, a tactic emphasized in some of the most popular digital marketing degrees online. This strategy directs potential customers to your site, reducing the need for paid channels.

Lowering your CAC follows as organic traffic is cost-effective and often better quality than paid traffic. Each visitor you attract without paying reduces your CAC directly. Moreover, delivering consistent, meaningful content strengthens your brand’s reputation. It not only lowers your CAC but also builds trust with your customers.

– Technology-Aided Reduction of CAC

Modern CRM systems, email automation, and AI-powered analytics can improve efficiency and personalize marketing, thus leading to higher conversion rates and reduced CAC. These technologies augment efficiency and tailor marketing approaches to individual customers, enhancing conversion rates.

The result is a more efficient, cost-effective customer acquisition process, signifying a significant reduction in CAC. It illustrates how embracing the right marketing trends can become a game-changer in managing your CAC effectively.

– Optimizing Average Order Value

By upselling and cross-selling, you can maximize your average order value. It, in turn, helps to absorb the CAC, making it an effective strategy to improve profitability. In persuading customers to buy more or pricier items each time they shop, you effectively spread the acquisition cost over a more extensive revenue base.

Similarly, consider whether raising your prices could work in your favor. This move can beef up your AOV, which can help even out your CAC. You can also pump up AOV by trying things like package deals, gift sets, or free shipping for orders over a certain amount.

– Lowering Product Costs

First off, consider trimming down operational and production expenses to balance out a higher CAC. It might mean talking with suppliers, making processes smoother, or cutting down on waste. Dive into your operational and production steps to find spots where you can save.

Try everything from striking better deals with suppliers to making processes more efficient and keeping waste in check. The idea is to have more cash to balance out a pricier CAC, making sure your profit margin stays strong.

– Refining Retention Strategies

Keeping your current customers is cheaper than acquiring new ones. By focusing on customer satisfaction and building strong relationships, you can improve retention and reduce the pressure on acquisition.

The emphasis should be on nurturing customer satisfaction and cementing robust relationships to keep your CAC in check. By elevating the customer experience and fostering loyalty through customer loyalty software, you strengthen retention rates and lessen the pressure to constantly win over new customers, thus effectively managing your CAC.

– Enhancing Customer Value

Extra value for customers, such as top-tier service or unique perks, enhances CLV. A higher CLV can counterbalance an increased CAC. A higher CLV means clients generate more revenue throughout their relationship with your business.

It improves your profitability and acts as a buffer, absorbing a relatively higher CAC and maintaining a healthy balance between acquisition cost and customer revenue.

– Efficient Sales Cycle Streamlining

Speeding up your sales cycle stands as a formidable tool for lowering CAC. A streamlined, efficient sales funnel propels potential customers towards conversion more swiftly, cutting down the time and resources spent on each lead.

Quickening this cycle doesn’t just save on marketing and sales costs but keeps prospects from losing interest, enhancing the chances of successful conversions. Therefore, refining your sales process fosters quicker customer acquisition, lowering your CAC.

Navigating the Profit Highway: Understanding Customer Acquisition Cost

Diving further into 2023, mastering your CAC is a strategic necessity. The better you understand CAC and the finer your skills in reducing it, the more your business stands to benefit in terms of sustainable growth and profitability. But, decreasing CAC paves the way for increased profits.

This article guided you to the maze of CAC, simplifying its definition and shedding light on impactful strategies for its reduction. It emphasizes the importance of organic customer acquisition, the effective utilization of technology, and the retention of customers. Implementing these strategies can significantly lower your CAC, boosting your bottom line.

Yet, remember, CAC isn’t a static metric. It warrants ongoing monitoring and dynamic adjustments to guarantee it remains in optimal range. This continuous process of keeping tabs on your CAC shapes your marketing strategies and decisions.

Please keep your eyes locked on your CAC, fine-tune it as necessary, and lead your business to greater profitability and growth in 2023 and beyond. A lower CAC isn’t just a number. It’s a marker of business success and competitive advantage in today’s dynamic commercial landscape.

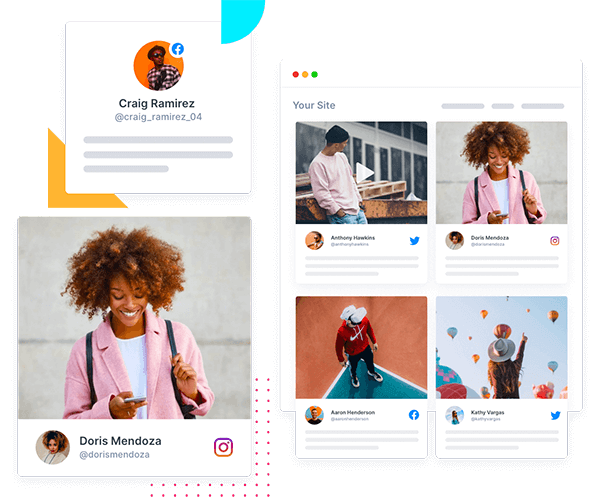

Embed social feed from Facebook, YouTube, Instagram, Twitter on your website, like a PRO

Invalid Email Address